Carbon Accounting is the modern language of climate change. It’s how companies share their climate story transparently and accurately today. Measuring companies, individuals, events, and countries’ carbon footprints through Greenhouse Gas (GHG) accounting tools holds them responsible for their climate impact by quantifying it.

From a business perspective, measuring emissions through carbon accounting has become essential for climate risk mitigation, building a decarbonization strategy, and ESG and sustainability compliance. New regulations in the EU, US, and over 30 other jurisdictions around the world now require companies to measure and report on their carbon footprint.

Our Carbon Accounting 101 Guide is the ultimate resource for your company to learn how to conduct an emissions inventory or further refine its processes around collecting, calculating, and reporting GHG emissions data.

What is Carbon Accounting?

Carbon accounting, also known as greenhouse gas accounting or an emissions inventory, quantifies carbon emitted over a given time period. It an essential part of how a company measures the quantity of emissions they contribute and uncovers the sources of those emissions within their business. It also enables companies to assess climate risks, build ESG strategies, and track progress towards any emissions reduction goals.

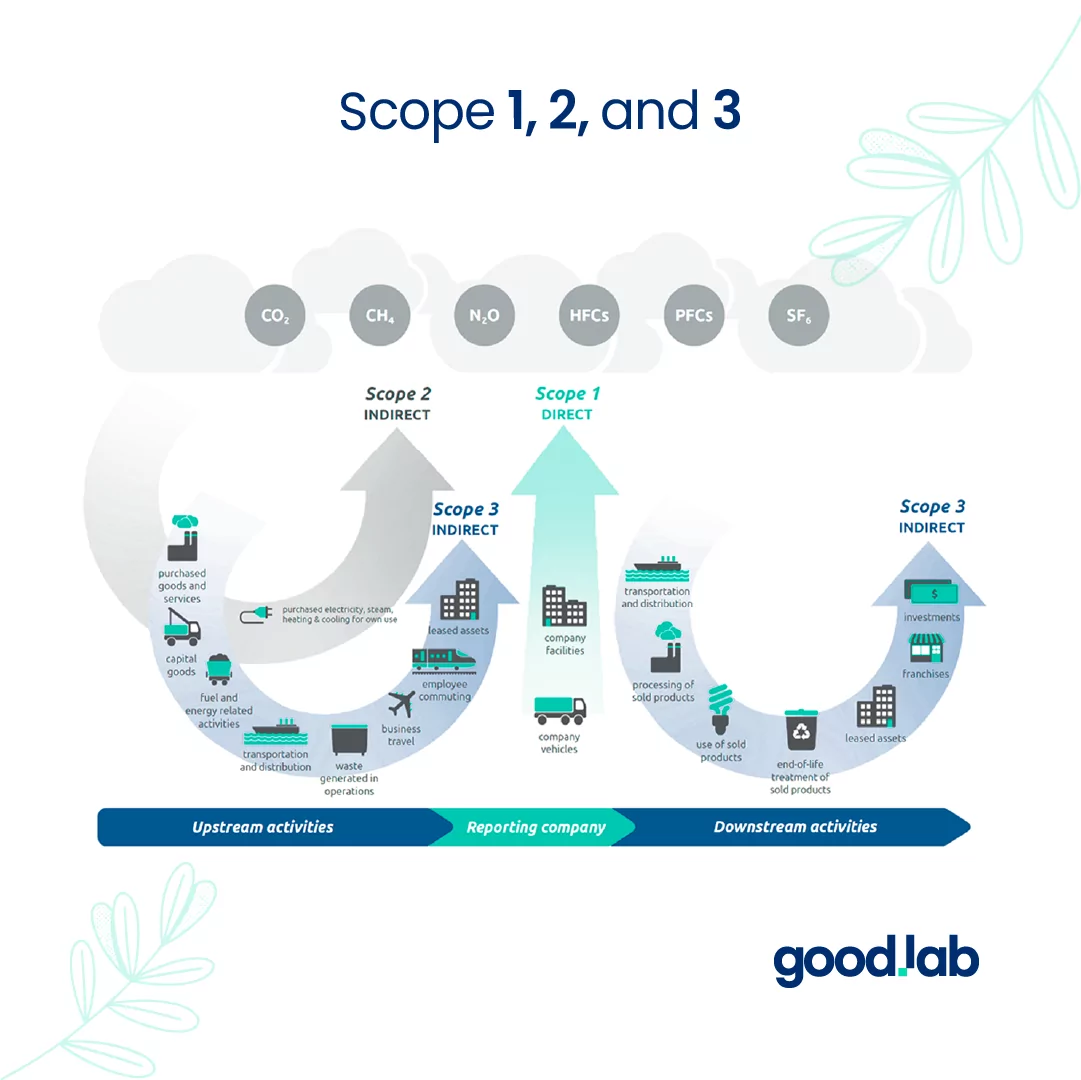

Creating an emissions inventory involves quantifying all designated greenhouse gases such as carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and fluorinated gases (F-gases), which include hydrofluorocarbons (HFCs), per-fluorocarbons (PFCs), sulfur hexafluoride (SF6), and nitrogen trifluoride (NF3), and turns them into a CO2 equivalent (CO2e) value for comparative measurement.

GHG accounting is also integral to complying with the growing demand from regulators and investors for accurate emissions data. As larger companies work to manage their Scope 3 emissions, which are, on average, 11.4 times greater than Scope 1 and 2, they are increasingly looking to their supply chain and asking their suppliers to measure and report their carbon footprint.

Five Reasons Carbon Accounting is Essential for Businesses

As global efforts to mitigate climate change accelerate, investors and regulators seek to better understand a company’s carbon footprint. As this scrutiny grows, accurate and up-to-date carbon footprints are essential, and more companies are acting on carbon accounting for the following five reasons:

1. Carbon accounting is essential for compliance as global regulations requiring companies to measure their carbon footprint increase at a rapid rate.

As of today, more than 30 countries and regions around the world require companies to calculate and report on their carbon footprint. Of those 30, the most far-reaching and important are those in the US and EU.

In Europe, the Corporate Sustainability Reporting Directive (CSRD) requires companies to report on Scope 1, 2, and 3 emissions. The CSRD will be phased in at the beginning of 2025 and will eventually require around 50,000 EU companies and 10,000 non-EU companies (including 3,000 US companies) to report emissions.

In the US, California’s SB 253, will require approximately 5,000 companies that do business in the state to report their carbon footprint annually beginning in 2026. The SEC is also predicted to release their climate rule in 2024, which would require publicly traded US companies to report their carbon footprint.

2. Data requests from major buyer organizations now require small to mid-sized companies to measure their carbon footprint.

With the global increase in climate disclosure regulations that require the disclosure of Scope 3 (supply chain) emissions larger companies impacted by these regulations are beginning to ask their suppliers to share climate data.

For example, Amazon announced in 2023 that it would start to require tens of thousands of suppliers to report their GHG emissions to reach its 2040 net zero targets. Amazon’s announcement is expected to affect the majority of the over 200,000 companies in their supply chain within the coming years and also would require suppliers to report emissions and set decarbonization targets.

3. Accurate GHG emissions data helps companies to assess climate risk.

Understanding your emissions footprint enables data-informed assessment of your company’s exposure to physical climate risks, such as extreme weather events, rising sea levels, wildfires, etc.

Additionally, this visibility will help your company comply with climate risk disclosure regulations and understand the parts of your business most at risk from changing consumer trends, low-carbon technological advancements, and market changes, also known as transition risks.

Detailed carbon accounting can help your company build strategies to mitigate these risks and exploit opportunities.

4. Carbon accounting and its results are an integral part of sustainability & ESG reporting.

Whether through a mandatory disclosure or voluntary reporting, if you are reporting on sustainability performance, carbon footprint, and tracking progress toward your carbon goals is essential.

Companies that misstate their carbon footprint or progress toward climate targets with inaccurate reporting run the risk of greenwashing. Greenwashing is not only a brand reputation risk, but it is also increasingly becoming a litigation risk, with firms like Fiat Chrysler agreeing to pay $9.5 million for greenwashing their emissions. Examples like this further the case for accurate and comprehensive collection, calculation, and reporting of emissions data.

5. Measuring carbon can differentiate your services and products, creating a competitive advantage.

Consumers, investors, and other stakeholders prefer low-carbon products and services. Companies that create a detailed carbon footprint can uncover which parts of their business are the most carbon-intensive to uncover areas of energy and cost savings. Transparently sharing your efforts to track and reduce your carbon footprint can differentiate your products and services.

Which Companies Should Account for Their Carbon Footprint

Every modern business, regardless of size or industry, should consider accounting for their carbon footprint. Not only does this reflect a company’s commitment to environmental stewardship, but it also aligns your company with the growing expectations of customers, investors, and regulatory bodies. Following are three industries that should prioritize conducting carbon accounting:

- Private Equity: Private investors who measure the emissions of their portfolio have a better understanding of their exposure to climate risks and can make more informed investment decisions.

- Manufacturing: Given this sector’s high energy usage and exposure to global emissions regulations, manufacturers that measure their emissions can ensure they are compliant and differentiate their products.

- Consumer Goods: Accounting for product emissions can help CPG companies design products with minimal energy use, reduced costs, and increase their appeal to more eco-conscious consumers.

How To Measure Your Company’s Greenhouse Gas Emissions

Now that you’re convinced on why you need to measure your company’s carbon footprint, here is how it actually gets done. The first step is to align your carbon accounting process with a carbon accounting standard.

GHG Reporting Standards

To make sure your GHG accounting is comparable, consistent, and accurate you need to use a recognized reporting standard. The gold standard for carbon accounting are those of the GHG Protocol which have been the most used since its inception in 2001.

The Greenhouse Gas Protocol

The Greenhouse Gas Protocol (GHG Protocol) was created by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD) in 2001. They created the GHG Protocol Corporate Accounting and Reporting Standard for companies, cities, and countries to track progress toward climate goals and to ensure carbon footprints are conducted under the principles of relevance, completeness, consistency, transparency, and accuracy. They divide emissions into three main scopes:

- Scope 1: Direct emissions that are created in company-controlled vehicles and facilities

- Scope 2: Indirect emissions created from the purchase of electricity, steam, heating, and cooling

- Scope 3: The 15 categories of upstream and downstream indirect emissions from across a company’s value chain

The GHG Protocol is the primary resource for companies and nations to measure their carbon emissions and is what most climate disclosure regulations are built upon. Despite the GHG Protocol being the most recognized, there are other GHG accounting standards that can be used to supplement reporting:

- The Partnership for Carbon Accounting Financial (PCAF) was created specifically to deal with complex “financed emissions.” These are covered under Scope 3 Category 15: investment activities in the GHG Protocol, but are complex, so they need more in-depth guidance. The PCAF worked with the GHG Protocol to be an extension of their existing standard for carbon accounting. PCAF also has standards for facilitated emissions (emissions from financial transactions) and insurance-specific emissions.

- The Bilan Carbone Method was created by the French environmental agency for companies to report their emissions. Although very similar to the GHG Protocol, it differs in some key areas: Companies on the Bilan Method are not allowed to exclude Scope 3, whereas in the GHG Protocol, they are. Also, with the Bilan Carbon, companies must include all facilities and create a decarbonization plan, but with the GHG Protocol, this is optional. Although used extensively in France, it is very rarely used in other countries.

- The ISO 14064 was created in 2006 and is also based on the GHG protocol. It is designed to work in tandem with the GHG Protocol, with the GHG Protocol providing the best practices for accounting and ISO 14064 defining the minimum standards to comply with the GHG Protocol. ISO 14064 is divided into three parts: Part 1 is for guidance on creating an emissions inventory, Part 2 is for project-based carbon accounting, and Part 3 is for GHG data verification and auditing.

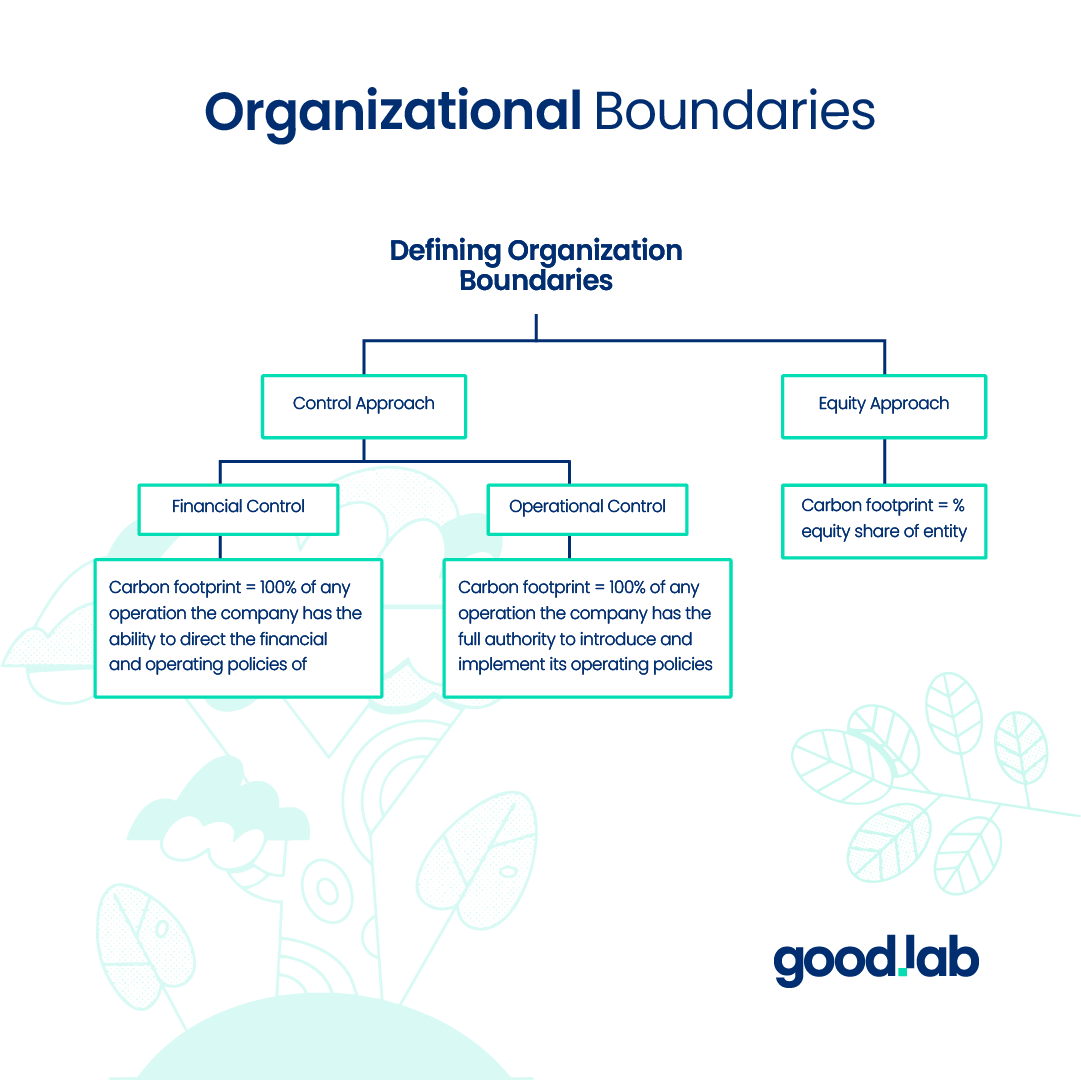

Defining Organizational Boundaries

Defining your company’s organizational boundaries is the first (and one of the most challenging steps) in the carbon accounting process. The GHG Protocol defines two distinct approaches to setting organizational boundaries, the equity share and control approach:

Control Approach: In the control approach, a company takes 100% ownership of the emissions from operations over which it has complete control. When using the control approach, companies decide to use either financial or operational control:

- Operational Control: Operational control refers to when a company has full control over introducing and implementing policies within the operation.

- Financial Control: Financial control refers to when a company has the ability to direct financial and operational policies with the goal of gaining economic benefits.

Equity Share Approach: Under this approach, the reporting company accounts for GHG emissions according to its share of equity in operation. For example, if an asset manager owns a 30% equity stake in a company, it will account for 30% of the company’s carbon footprint as their own emissions.

When selecting which method best suits your company’s needs, some things to consider include:

- Why are you calculating emissions? Financial control may be recommended if you assess climate-related financial risk, whereas operational control may be more applicable if you are trying to build a decarbonization strategy.

- Who are you calculating emissions for? If you are calculating for investors, financial control may be more applicable. Otherwise, the control approach is probably applicable.

- What type of company are you? If you work in a sector, such as energy or manufacturing, that has substantial emissions from your operations (Scope 1), you will likely choose operational control. However, you may choose financial control if you are a large multinational with an investment portfolio and subsidiaries.

GHG Emissions Calculation Methodology

Once you have defined your boundaries, you can begin collecting data and calculating emissions. Following is an example of data collection and calculation for each scope using widely accepted methodologies:

| Scope | Description | Emissions Example | Calculation Example |

|---|---|---|---|

| 1 | Direct emissions from owned or controlled sources | Vehicle Fleet | Mileage in vehicle type x (emission factor per mile) |

| 2 | Indirect emissions from the generation of purchased energy | Purchased Electricity from US grid | kWh consumed x (emission factor per kWh for regional grid mix) |

| 3 | All other indirect emissions that occur in the company’s value chain | Purchased Goods | Spend-based method: Monetary value of goods x (emission factor per monetary unit) |

Emissions Factors in Carbon Accounting

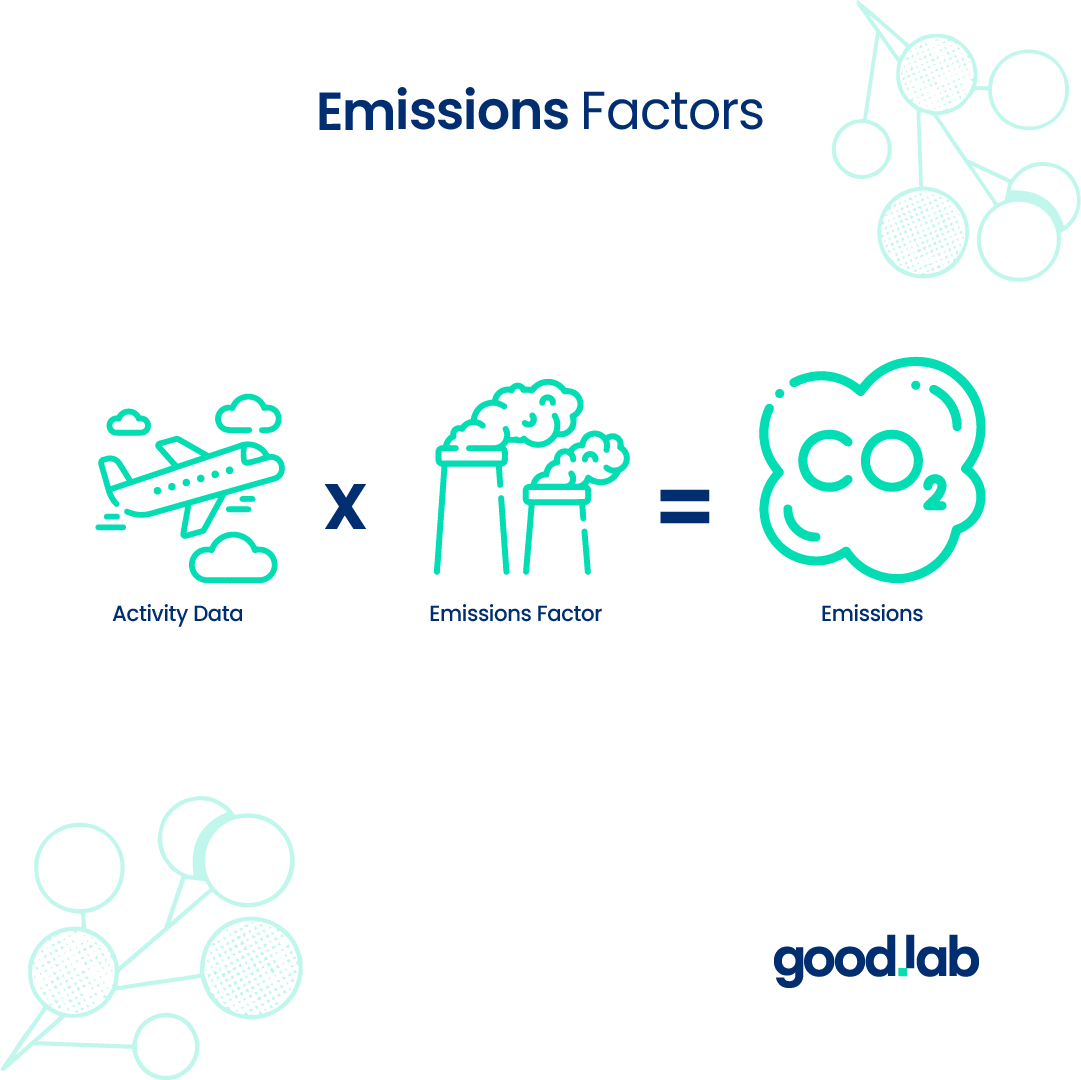

Emissions data typically can’t be collected directly. Therefore, companies collect activity data (miles traveled in a car or plane, money spent on raw materials, or liters of fuel used for example) and then calculate their activity data using emissions factors.

There are thousands of emissions factors for geographic and activity-specific actions that produce emissions. Following is an example of activity data, emissions factors, and resultant emissions:

| Activity Data | Emissions Factors | Emissions |

|---|---|---|

| (Scope 1) 10,000 gallons of diesel used in US vehicle suite | US EPA 2023 Emissions Factors: Diesel Fuel 10.21 kg CO2 per gallon | 102,100 kg CO2 |

| (Scope 2) 10,000 MWh of energy purchased in Texas | eGRID Summary Tables 2022: Texas energy mix (ERCOT) 821.9 lb CO2eper MWh | 8,219,000 lb CO2e |

| (Scope 3 Category 1) $10,000 purchased goods storage batteries in the US | EPA EEIO Supply Chain Greenhouse Gas Emission Factors: Storage Battery Manufacturing 0.314 kg CO2 e/2021 USD | 3,140 kg CO2e |

With so many emissions factors to keep track of today, the most accurate way to measure emissions is through a software solution that embeds specific emissions factors into its calculation methodology and offers spend and activity based calculations.

Carbon Accounting Auditing & Assurance

To ensure you are accurately measuring and reporting on their GHG emissions, your company should have its carbon footprint audited by a trusted third-party. This type of data assurance falls under two main categories:

- Limited Assurance: Somewhat less stringent, limited assurance ensures that companies are using the correct calculation methodologies and emissions factors to arrive at their total emissions.

- Reasonable Assurance: The more in-depth, reasonable assurance, includes everything from limited assurance, plus it includes site visits and testing to ensure all raw data was collected accurately.

Auditing emissions is part of many reporting regulations globally and in the US, the SEC proposal and California’s SB 253 both would require companies to start with limited assurance before enforcing reasonable assurance measures.

Compliance is just one of the many reasons your business should audit its carbon footprint. With litigation for greenwashing becoming more prominent having assured GHG emissions data reduces this risk.

What to do With Your GHG Emissions Report

Once you have your first carbon footprint there are several ways to report and share the results. Following are a few ideas of some actions you can take to share your results and bolster your company’s sustainability narrative with accurate and transparent data:

- Share on Social: Highlight your company’s commitment to climate and sustainability on social media platforms. Communicates your sustainability commitments and achievements in subsequent years and as you progress towards any emissions reduction goals.

- Join Emission Pledges: Align your company’s decarbonization goals with a net zero business group, like the We Mean Business Coalition or, get your net zero goals validated by the Science-Based Targets Initiative (SBTi).

- Write a Sustainability or ESG Report: Compile an annual report aligned to common climate reporting standards, like the ISSB, to transparently share the results of your carbon footprint and other sustainability performance metrics.

- Share with Business Partners: Its no secret that ESG and climate data requests are running rampant in supply chain communications. If they aren’t already, you can anticipate that your customers will soon request your emissions data. Share this data with companies in your value chain to signal your commitment to sustainability and to help them gain visibility over their own extended carbon impact.

Challenges of Carbon Accounting

Despite the importance of carbon accounting as the table stakes of doing business today, few companies actually measure their full carbon footprint. The reasons companies drag their feet on measuring their full carbon footprint are multifaceted, however, we typically hear any combination of the following factors:

- Limited Access to Data: The collection of data for GHG accounting is difficult. It can be siloed in different parts of your business operations or supply chain. The finance department may have business travel data and energy bills, while procurement has supply chain data, and human resources has data on employee behaviors, such as commuting or work from home impact. Strong data governance strategies are key to reduce the complexities of collecting your emissions data.

- Double Counting: Double counting can occur in carbon accounting, as company activities can be easily misinterpreted or misattributed to an incorrect scope. Companies can avoid double counting their emissions by reviewing each category to look for any duplication errors.

- Poorly Defined Boundaries: To avoid double-counting, companies need to clearly define their organizational boundaries. This can be challenging as there are multiple methods, e.g. equity share approach, financial control, operational control. The key here is to lock into one approach early on and clearly define the boundary.

- High Cost: With so much data to collect and advanced education needed to calculate the data, carbon accounting may be cost-prohibitive for some companies to do internally. For companies that fall under new carbon disclosure regulations, like the SEC climate disclosure rule, one estimate is a cost of at least $533,000 annually to stay compliant. However, modern GHG accounting software platforms can significantly bring these costs down and eliminate cost-related objections with lightweight and speedy automated calculations within days, not months.

How Carbon Accounting Software Simplifies GHG Calculations

Manual data collection and calculation can be daunting, especially when first getting started. Adding in all the data and determining which emissions factor to use often requires a specialized expertise. Your software solution should ideally simplify carbon accounting, however, with so many platforms on the market today there are a few key things to keep top of mind when selecting a vendor:

- All-Scopes Emissions Tracking: Ensure your software provides comprehensive coverage of Scope 1, Scope 2, and, crucially, Scope 3 emissions to give you a full picture of your carbon footprint.

- Product-Level Emissions Calculations: The ability to calculate emissions down to the product level gives you a much more granular view of where your emissions are coming from and is really the next level of carbon accounting. This will become more important for building strategies, working with suppliers, and meeting new regulations, like the European Battery regulation that requires companies to measure and record the footprint of battery products using a product passport.

- An Audit Trail: With more companies facing threats of greenwashing accusations and regulations that stipulate assurance measures, your software platform should have fully auditable data trails that streamline the assurance process.

- User-Friendly Interface: Your emissions software should be accessible to all team members, regardless of their technical expertise, with a user-friendly interface given the many data inputs from across your company. Most importantly, your software should ideally be supported by experts who can walk you through complex climate calculations.

Good.Lab Can Simplify Your Company’s Carbon Accounting

As you can see, there is a lot that goes into carbon accounting. However, it is no longer optional but an integral part of assessing risk, decarbonizing, and meeting new climate reporting regulations. It may seem daunting, but it doesn’t have to be. Carbon accounting experts, equipped with right-sized software tools, can streamline the process. If you need support with your carbon accounting journey, let’s talk!

Carbon Accounting FAQs

GHG accounting or carbon accounting refers to the process of measuring the amount of greenhouse gases emitted by an entity, such as a company, government, product, or individual, over a specific period, usually a year. It is an integral part of assessing a company’s carbon footprint, exposure to climate risks, and progress on decarbonization.

Currently, for most companies, GHG accounting is voluntary. However, GHG accounting and reporting of emissions is mandatory for some companies in regions such as EU member states, The UK, Japan, and others. Currently, in the US, at least 5,000 companies will be expected to conduct carbon accounting and report emissions under California’s SB 253 by 2026.

Carbon Accounting is much more difficult than traditional financial accounting. Data comes in many different forms and must be calculated using different emissions factors.

The main greenhouse gases included are carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and fluorinated gases (F-gases), which include hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur hexafluoride (SF6), and nitrogen trifluoride (NF3). These are usually expressed as a CO2 equivalent.

Scope 1 emissions are direct emissions from owned or controlled sources.

Scope 2 emissions are indirect emissions from the generation of purchased energy.

Scope 3 emissions are all indirect emissions (not included in Scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

Scope 3 emissions are so difficult to measure because they come from sources not owned by the company, tied up in complex value chains. This means data is not always available and is often inaccurate. Due to its complexity, companies often make industry-average estimates of their Scope 3 emissions based on spending data.

Organizations measure their GHG emissions by identifying emission sources, collecting activity data (such as fuel consumption and miles traveled), researching appropriate emission factors, and applying calculation methodologies as per established protocols like the Greenhouse Gas Protocol. They can simplify this whole process by using a software-based GHG calculator.

A carbon footprint is the total amount of greenhouse gases emitted by an individual, organization, event, or product, expressed as a carbon dioxide equivalent.

Disclaimer: Good.Lab does not provide tax, legal, or accounting advice through this website. Our goal is to provide timely, research-informed material prepared by subject-matter experts and is for informational purposes only. All external references are linked directly in the text to trusted third-party sources.