Across the board, businesses are now expected to play a role in transitioning to a low-carbon, sustainable economy. In every company, every employee has a role to play when it comes to ESG, from the C-suite to the intern, each role can ensure that a company’s ESG performance matches its ambition.

For example, a Chief Financial Officer may be interested in ESG from a risk perspective and will look to shape policies based on an ESG or climate-related risk mitigation standpoint. Meanwhile, a Chief Marketing Officer may look at sustainability from a brand reputation point of view and implement and communicate policies they believe will have the biggest impact on potential customers’ buying decisions.

Given that each role can contribute to and benefit from a company’s ESG initiatives and sustainable practices let’s dive into how your specific role within your company will be shaped by (and shape) ESG in the coming years.

Who is Responsible for Leading ESG in a Mid-Market Company

Every role at every company holds some responsibility for ESG; whether executives are implementing policies or shaping company culture or employees are implementing those policies and embody that culture.

From a leadership perspective, although executives and upper management have some sway over a company’s ESG and sustainability policies, the leadership usually falls to one person. This leader typically works to align all stakeholders around an overall ESG strategy and determine material areas of focus.

In enterprise companies where executives’ pay is increasingly linked to ESG performance, with 73% of S&P 500 companies linking compensation to some ESG metric, up from 66% the previous year. Dedicated ESG teams or a Chief Sustainability Officer (CSO), take on the bulk of ESG leadership.

However, in SMEs, responsibility for ESG leadership can fall under a wide range of executives’ purview, as they may not have ESG-specific roles. In the mid-market, sustainability responsibilities are often shared among other executives. COOs could be driving sustainability across company supply chains, whereas the CEO shapes sustainable company culture, and a CFO might focus on mitigating ESG-related risks.

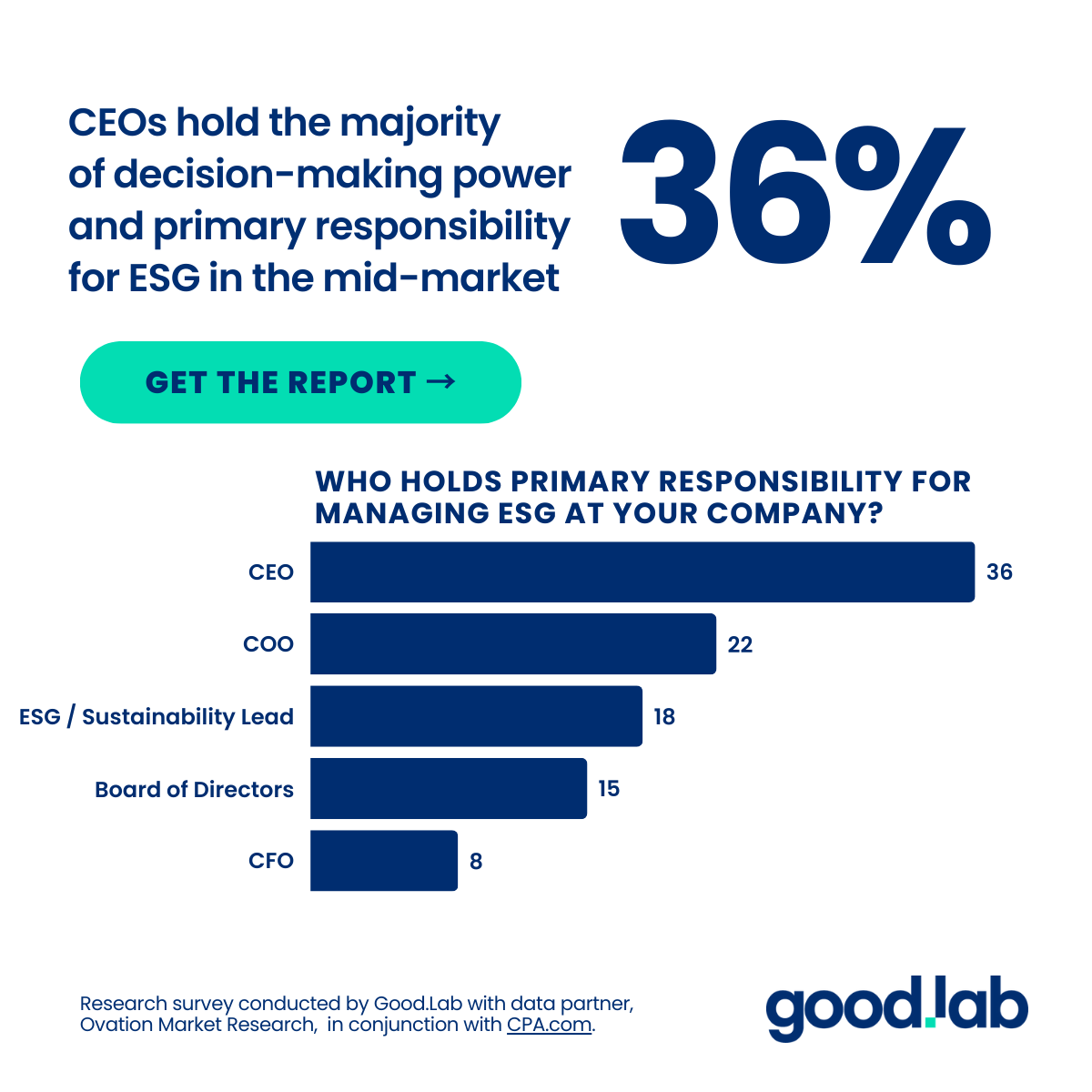

Our recent ESG Trends Research conducted in collaboration with CPA.com found that the CEO holds the majority of responsibility for driving ESG in mid-market US companies, followed by the COO.

From the role of executives making new ESG policies, to employees enacting those policies, and investors, shareholders, and customers supporting and benefitting from a company’s ESG program, every stakeholder has a role to play. However, strong ESG leadership leading sustainability policies and culture is critical to ensuring high ESG performance.

Each role in the C-Suite has different goals, is confronted with different challenges, and can benefit from ESG in distinct ways. A breakdown of how CEOs, CFOs, COOs, and other leadership roles are impacted by sustainability, the drivers, challenges, and initiatives of each role, and how Good.Lab can help you make the most of ESG in your specific role is described below:

- Drivers: Pressure from regulators, stakeholders, investors, customers, and competitors are the biggest motivating factors for CEOs. As the face of a company, the CEO will also want to improve their public persona by ensuring their company is ethical and sustainable. CEOs are also increasingly seeing ESG initiatives improve financial performance, with 45% agreeing it will improve revenue in 2022, up from 37% the year before.

- Challenges: For some CEOs, competing interests may be their biggest challenge for embarking on ESG initiatives, balancing long-term sustainability goals with short-term quarterly revenue goals. Change management is another challenge as the CEO attempts to shift company culture to a more sustainable one. The threat of fines for non-compliance or loss of brand reputation for greenwashing is also a challenge.

- Initiatives: CEOs will likely be the ones to set the ambition level for companies’ ESG targets, whether it is increasing recycling rates, saving water, or net zero emissions. They will also be the ones adopting initiatives that will ensure sustainability is woven into the company’s culture and that all other parties know their responsibilities.

- Benefits: Both the company and the CEO’s brand reputation would be improved by an ambitious ESG program. Attracting new customers and investors and improving the company’s long-term financial prospects. They could also benefit financially as companies are increasingly linking executive pay to ESG performance.

- How Good.Lab Helps CEOs Win on ESG: CEOs need to build a trusted team around them and find the right external advisors who stay up to date on regulations and can assist with strategy. Good.Lab provides sustainability advice at every step of the ESG journey and can help CEOs at every stage, from taking their first steps to producing a yearly sustainability report.

- Drivers: CFOs will be mostly driven by identifying and reducing ESG-related financial risks. They will also consider the efficiencies and cost savings that sustainability initiatives could bring and are responsible for non-financial reporting to be added to financial reports like 10-ks.

- Challenges: ESG initiatives can be expensive. Finding a budget for the necessary investment in third-party vendors, tools, and initiatives can be difficult, especially when trying to balance short-term financial goals with long-term sustainability targets.

- Initiatives: Allocating funds for ESG initiatives and projects, finding sustainable investment options, and tax incentives. Ensuring all sustainability-related financial reporting is accurate. They will also measure the impact of climate and other sustainability impacts on the company’s finances.

- Benefits: Improved efficiency, long-term financial resilience, attracting new investors, saving costs, and tax deductions.

- How Good.Lab Helps CFOs Win on ESG: CFOs will need rigorous ESG data to understand and assess risk more accurately and comply with regulations. Good.Lab’s software solution gives CFOs accurate measurements of their emissions through our GHG calculator and can help them prepare for any regulation they are facing.

- Drivers: Ensuring operations are running efficiently and are in ESG regulatory compliance. Supply chain due diligence pressure, ensuring human rights are not being exploited, and supply continuity. New regulations include Scope 3 and supply chain sustainability data reporting.

- Challenges: COOs’ main concern will be managing complex supply chains, getting data from them, understanding their exposure to sustainability-related risk, etc. COOs will also find it challenging to adopt new ESG initiatives across operations and supply chains.

- Initiatives: Considering the majority of most companies’ sustainability impact lies in their supply chains, COOs are likely to focus their efforts there. Implement initiatives to source sustainable products and circular economy principles. They will also attempt to reduce energy use and emissions within the companies’ operations.

- Benefits: COOs can expect to mitigate risk in their supply chain, ensuring supply continuity and limiting damage to brand reputation. They could also benefit from cost reductions through operational efficiencies.

- How Good.Lab Helps COOs Win on ESG: A COO will need to de-risk supply chains and work with supply chain partners to collect data and explore shared goals. Good.Lab can help COOs by giving them an understanding of the risks in their operation and supply chains with our Climate Risk Readiness Assessment.

- Drivers: As sustainability is central to their role, CSOs’ main driver is to make the company as sustainable as possible. They will also be motivated by creating good governance practices, engaging with all stakeholders on sustainability, and ensuring compliance with all relevant regulations.

- Challenges: A CSO’s primary challenge will likely be getting buy-in across the whole company, balancing the competing interests of the company, and changing the company culture. Keeping up with the quickly evolving regulations and ESG reporting landscape and collecting data to report is also a challenge.

- Initiatives: CSOs will bring in different internal and external stakeholders to build effective ESG strategies. They will also likely collect ESG data for compliance or voluntary reporting. All of the environmental and social programs that the company undertakes will be overseen by the CSO.

- Benefits: An effective, impactful ESG performance can allow CSOs to build a positive brand reputation, attracting impact investors and eco-conscious customers.

- How Good.Lab Helps CSOs Win on ESG: CSOs need the tools and expertise to collect and aggregate all of a company’s ESG data and good communication with all stakeholders to win. Good.Lab can give sustainability leads the software to collate accurate ESG data and the expertise to help perform any ESG initiative their company needs.

- Drivers: CMOs will be driven to improve their companies’ brand reputation and use sustainability as a differentiator vs. competitors.

- Challenges: The main challenge marketing leaders face is ensuring the company is not greenwashing. This involves a difficult balancing act of communicating sustainability issues supported by evidence while meeting marketing goals.

- Initiatives: Branding products or services as sustainable and engaging more sustainable-focused consumers and customers with sustainability-led marketing campaigns and developing a compelling narrative that effectively conveys the company’s ESG program and shares that in a glossy annual sustainability report.

- Benefits: Considering sustainable-labeled products have been shown to outperform non-sustainable products, CMOs can benefit from high ESG performance from increased sales, improved brand reputation, and market differentiation

- How Good.Lab Helps CMOs Win on ESG: CMOs need to ensure they have accurate metrics and share them transparently. Good.Lab can ensure your metrics are accurate and current and will help you share them in an annual report.

The Operational Role of Management in ESG

The responsibilities of ESG go far beyond the executive board room. It is the responsibility of managers of all levels to actually put ESG into action and communicate policies and strategies to employees.

Managers are an important go-between in giving feedback to executives to improve policies. Sustainability professionals are responsible for driving ESG strategies, human resources plays an essential role in fostering social equity and sustainable culture, and legal roles act to ensure compliance and that ESG is integrated into contracting.

Taking a role-based approach to ESG within your company ensures alignment on policies and culture, harnesses the strengths and expertise of individuals within your company, and enables your company to conduct a more tailored strategy leveraging the specific needs and strengths of your team members.

Although the designated ESG leader will ultimately have the final say, each role has an integral and specific part to play in ensuring the effectiveness of a company’s ESG program and will also benefit their role from strong ESG performance.

Consider how ESG impacts your role and, if these drivers, challenges, initiatives, and benefits resonate with you, whether you should be doing more and what sustainability wins you can help drive for your company – to do so, what tools do you need for success?

Regardless of your role, you are going to need support to get your ESG initiatives over the line, whether that is a consultant to help with reporting compliance or a software service to collect data for more informed strategies. You will need help along the way. Reach out to Good.Lab today to find out how we can help you excel in ESG in your role.